They illegally cheated many struggling borrowers out of their rights to lower repayments

Make them relinquish the ball

The New Statesman reprinted a chapter of the Hell World book today and it’s one of my favorites so go read it there if you like.

“People think we live in a harrowing dystopia but the world is really a lot dumber than that,” it says.

In January of 2017 the Consumer Financial Protection Bureau filed a suit against Navient the largest servicer of federal and private loans in the country and the company who you probably have to send a fucking payment to every month for the next decade or two or three of your life.

“For years, Navient, formerly part of Sallie Mae, created obstacles to repayment by providing bad information, processing payments incorrectly, and failing to act when borrowers complained,” the CFPB alleged. “Through shortcuts and deception, the company also illegally cheated many struggling borrowers out of their rights to lower repayments, which caused them to pay much more than they had to for their loans.”

No fucking way that doesn’t sound like Navient you’re probably thinking.

Navient handles the loans of over 12 million people including over 6 million borrowers under its deal with the Department of Education to the tune of about $300 billion which you would think just operating under reasonable and fair lending practices and common sense human decency would certainly provide everyone involved at the company to make a decent living off of and you would be right but of course that isn’t enough for companies like this to just take their (arguably) fair share of profits and go home they also have to squeeze every dollar they can out of struggling recent graduates and low income families because fuck them poor people.

The CFPB alleges all sorts of rat-fuckery Navient has been up to and it’s too much to summarize here you can read an overview of it here if you like. The nut of it to me which is relevant to the new filings is their alleged systemic practice of steering borrowers who qualify for income-driven repayment plans into forbearance.

“When borrowers run into trouble repaying their federal student loans, they have a right under federal law to apply for repayment plans that allow for a lower monthly payment,” the original suit explains. “But the Bureau believes that Navient steers many borrowers into forbearance, an option designed to let borrowers take a short break from making payments. But interest continues to add up during forbearance. Certain consumers with subsidized loans end up paying a heavy price because they could have potentially avoided those interest charges. From January 2010 to March 2015, the company added up to $4 billion in interest charges to the principal balances of borrowers who were enrolled in multiple, consecutive forbearances. The Bureau believes that a large portion of these charges could have been avoided had Navient followed the law.”

This is all separate by the way from a class action suit against Navient brought on behalf of public servants — teachers, nurses, first responders, fire fighters, public defenders and so on — who were supposed to be eligible for Public Service Loan Forgiveness that I wrote about back in May which I’ve also included at the end of this piece for reference.

Navient of course claims they did not do anything wrong and that it’s a witch hunt essentially and they filed for summary judgment in January saying the CFPB has had more than enough time to prove their case. The CFPB on the other side says that Navient has been fucking with them all along refusing to produce documents in a timely fashion during discovery and stonewalling as much as possible.

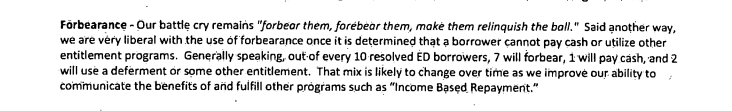

As a result the CFPB in March filed to delay summary judgment and newly unsealed documents from that filing have what appears to be something of a smoking gun. Among some of the more damning evidence includes internal Navient documents produced by the CFPB like the one below.

“Our battle cry remains ‘forbear them, forebear them, make them relinquish the ball,’” Navient wrote.

That seems bad to me does it seem bad to you?

Forbearance in case you don’t know but you probably do if you’re like me and you had to use it at one point or another is when you can’t pay back your loan so they agree to let you postpone payment for a certain amount of time. During that period however the loan continues to accrue interest which is good for the lender because you ultimately end up owing them more in the long run.

At issue is that instead of forbearance borrowers might instead often be eligible for income-driven repayment plans.

“IDR plans allow borrowers to pay an amount that is based on their current income and household size, thereby accounting for the fact that borrowers' incomes my fluctuate over time,” the CFPB explains. “The payments can be as low as zero dollars if a borrowers’ discretionary income is not sufficient to pay any portion of his or her student loans, such as during a period of unemployment.”

Of course the Hell Worldy explosion of freelance labor and gig economy workers also plays into this as jobs and payment schedules are no longer predictable and reliable making paying off student loans even more difficult.

Forbearance can be ok for short periods everyone agrees but much less so than IDR plans because the former allows interest to compound as I said but also that interest can then be added to your principal balance which then increases the amount of interest owed and so on in an infinite loop of shit. On top of that it might prevent the borrower from making any headway toward a loan forgiveness program.

“The high use of forbearance is also associated with increased rates of borrower defaults,” the CFPB write.

At question is whether or not they can prove that Navient did in fact steer borrowers toward forbearance instead of IDR plans and the CFPB has receipts that prove as much it appears at least to my untrained eye and brain.

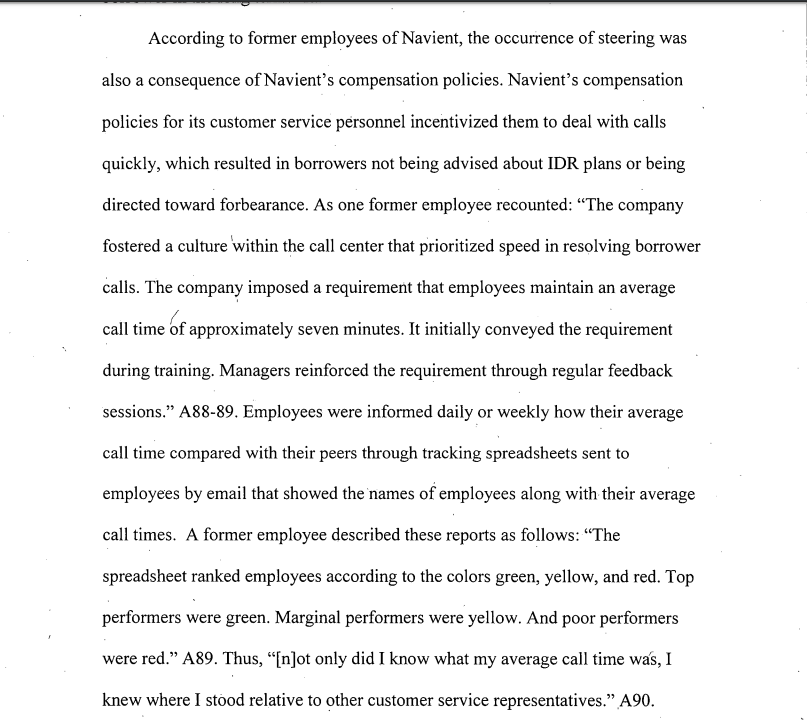

Former Navient call center employees and supervisors have told CFPB that they did not even realize that IDR plans were an option that they were supposed to suggest to callers and internal documents show a company culture that encouraged call center employees to keep call times as low as possible.

Navient says that they have technically sent customers all the information that they would need about their options in printed contracts and such but of course they know and the CFPB knows and you know and I know that the average person can’t be expected to read through the entirety of their contracts for anything never mind understand them if they do and in fact when confused and distressed they and we often rely on what we assume is the good faith advice of the people who answer the phones at the call center who are in theory and in law supposed to have our best interests in mind. That is very hard to do in the space of a few minutes though especially when the call center employees are under immense pressure to do traffic and also not even really clear on what the fuck it is they are supposed to be able to tell people.

“Navient employees understood that the way to achieve short call times was to offer forbearance. A forbearance call they say would take about 3.5 minutes. IDR would take much longer,” the CFPB states.

Essentially it would be like if you went into a restaurant and the server was slammed and in order to get your order faster so they could move on to the next table they told you the special of the day was a $5,000 steak and when you asked if there was anything else they were already gone. Guess I’ll go fuck myself then you’d say.

That’s the additional Hell World bonus here. There is always double dipping for these companies. Fucking the customers isn’t enough they also have to squeeze their employees on the other side and in this case that’s making excessive demands to keep call times down. This has the primary effect of depriving borrowers of having accurate and sufficient information to manage their loan burden but also on the other end engendering employment performance anxiety in the day to day life of the absolute minimum number of workers they can feasibly employ who themselves very likely have loans of their own. Thus is the worker employed in the ruin of their fellow worker at the behest of capital.

“The evidence unsealed today in federal court confirms that Navient’s practices that added billions of dollars of debt to struggling borrowers emanated from the top echelon of the company,” Seth Frotman of the Student Borrower Protection Center said in a statement on the revelations. “This follows a decade-long pattern of Navient ripping off service members, disabled veterans, teachers, and American taxpayers. The time has come for policymakers to admit this company’s practices are predatory and corrupt—it should not be given a single additional taxpayer dollar.”

I wonder how much money the guy who wrote the memo about forbearance being Navient’s battlecry makes. I wonder what his life is like. I wonder if he’s happy. I wonder what he tells people he does for a living and if he considers it work?

Is he embarrassed about what he does and if so why not?

Ok now I’m gonna include the previous piece I did on Navient below for people who never read it so if you already did you are dismissed for today good bye.

How much do you owe in student loans? As I believe I may have mentioned on occasion I still owe… hold on let me log in to my handy Navient payment portal and double check [movie hacker keyboard scene] OK I’m in. Holy shit it’s under $30,000 for the first time in my long ass life. I currently owe a mere $29,494.96 which is a fair market price for a 2019 Hyundai Ionic a car I’ve never heard of. Not bad. I don’t own a home and I drive an old Toyota Corolla but my student loans almost twenty years later are finally under thirty big ones which is a victory of sorts.

I wonder if I could get my hands on one of those Ionics and drive it down to Wilkes-Barre, PA 18706 an address that is seared into my memory from years of mailing in monthly checks and park it in the lot out front with a note saying what say we call it even? A funny way to get back at Navient in my opinion would be to help me pay off my loans by subscribing to Hell World with money lol. Imagine how owned they would be.

I was thinking about my student loans because I am awake but also because as I said the other day in this paid-subscriber-only Hell World there was some exciting news in the world of loan servicing recently.

Congrats to Navient the company whom we all love and know about.

I asked readers to message me with stories of their own struggles dealing with Navient the company that handles about$206 billion in federal student loans owed by around 6.1 million of us which is out of the $1.4 trillion lol in U.S. education debt held by 43 million people. My intent was to share their stories here and then a weird thing happened. I heard from people who said the company seemed to be deliberately fucking with them or pretending like payments didn’t come in on time. People said they got late fees for things they shouldn’t have or had their employment prospects or security clearances for government work waylaid over defaulted payments despite having proof they had in fact paid. None of that will sound surprising to you.

I decided not to share them here in detail because to be honest they weren’t exactly scintillating narratives. Reading about how people have had their lives fucked with by student loan companies just felt like reading about how people were annoyed by the traffic on their commute like it’s something we all take for granted as a given in the world and we all have to deal with it and there’s nothing unique about it.

Admitting that is depressing though because it shouldn’t be that way. One struggling person getting jerked off by a billion dollar company should be front page news but it’s not it’s just Wednesday. It’s like how reading about someone being killed by a collapsing building is exciting but a story about someone slowly being crushed to death over the course of decades as we pile one single tiny pebble on top of them a day at a time doesn’t exactly get the blood pumping. Unless it’s you under the stones that is. Or how someone being shot to death is news but a bullet hovering in front of them suspended in mid-air and approaching at a rate of one millimeter a week over the course of their entire life doesn’t count as anything. Call me when the bullet arrives we’d say.

That bullet story actually sounds like it could work come to think of it someone let me know when magical realism is a thing again. The Boy With the Bullet Halo I’d call it. A striking metaphor for the American condition the reviews would say.

The bulk of my remaining student loans went to a fiction and poetry writing MFA I never turned in my thesis for after all.

Oh by the way I went on a nice young person’s podcast to talk about poetry and socialism and Hell World recently if you want to listen go ahead.

Did you know by the way that people who don’t complete their degrees are three times as likely to default on their loan as people with a degree? Makes sense I guess because it’s demoralizing enough to have to pay off loans in the first place never mind having taken out a huge loan for nothing.

The point I was about to make a few paragraphs ago is that an important condition of Hell World is for the suffering of others at the hands of the predatory and powerful to become pedestrian and boring in our eyes and then for the same thing to happen in turn to our own struggles. This is just how it is we say.

You know how teenagers and college kids are rip shit and red assed all the time about injustice and people mock them for not knowing how the real world works and not yet having had the submission beaten into them? That is one of the cruelest things we conspire to do to people I think. Rage is unbecoming and immature we teach them and we say grow up and then we saddle them with so much debt that they usually have no other choice but to shut the fuck up and get to work.

Everyone was very excited about how that billionaire bought off the student debt of the class of 2019 at Morehouse College the other day. The total came to about $40 million for a class of around 400 people so that’s like $100,000 a pop which is very cool to think about one specific class of one small school starting off at square zero already $40 million the hole. Robert Smith the billionaire in question has also fought against closing tax loopholes for the supremely wealthy like himself though so let’s not all suck him off just yet. There is not now and never will be such a thing as a charitable billionaire and if you you got warm and fuzzy about the Morehouse story wait until you hear the one about making all of the billionaires pay for all of the students to go to any college for free.

One quote from a Navient borrower which I mentioned in the piece the other day I’m going to bring back here again because it was so brutal and spot on. It was from a guy who had resisted paying his loans with a debit card for much of his life until recently because he didn’t trust them with it.

“When I worked in billing disputes for a credit card company the only people we had more disputes with besides Navient were Verizon and Girls Gone Wild,” he said. “That’s the kind of company they are.”

Here’s something: did you know that “since 1983, college costs have grown more than 700 percent—faster even than healthcare costs and five times greater than inflation.”

I know that because I was just reading a letter written by Jack Remondi President and CEO of Navient about how to improve the student loan process.

Remondi makes around $6.5 million a year or a little over $1 per each borrower Navient has. Here’s some other stuff he wrote:

Our higher education system does an excellent job enrolling students, but it is failing to graduate far too many: just 59 percent of Americans graduate from bachelor's degree programs in six years, and the rate is even lower at less selective colleges. There are a variety of reasons for this, including academic preparedness, financial resources and other life events. Leaving school without a degree is easily the single largest factor driving student loan defaults. Non-completers, who typically owe less than $10,000, are nearly three times more likely to default than their peers with a degree. In fact, two thirds of people defaulting owe less than $10,000, while those borrowing more than $40,000—a debt level that generally signals advanced degree completion—account for only 4 percent of defaults.

The rising cost of college and increases in borrowing have led to the expansion of extended repayment plans. Today, nearly 50 percent of all Direct Loan balances are enrolled in one of several income-driven repayment plans. In many cases the monthly payment due is so low that the balance is “negatively amortizing,” that is, adding rather than reducing the amount owed.

Then he goes on to lay out a number of solutions for helping to stop the bleeding so to speak all of which are nice sounding but I don’t trust him and I don’t believe he or anyone at Navient actually cares about any of that shit do you?

“My company, Navient, has more than 580 million interactions with student loan borrowers every year, giving us a front-row seat to what works and what doesn’t,” he wrote.

The reason why I don’t believe he or anyone at Navient really cares is because of obvious shit I don’t need to explain about how capitalism works but also because of a class action suit filed in New York being brought by eleven members of the American Federation of Teachers in various states on behalf of themselves and other public servants. Each of the plaintiffs are Navient borrowers who detail all the specific ways in which the company fucked with them or mislead them which you can read about more in brief here. The suit in particular revolves around the issue of the Public Service Loan Forgiveness program which is something they allege Navient very much does not want its borrowers to be aware of or avail themselves of.

Later on in this piece I have an interview with one of the lawyers bringing the suit against Navient a woman named Lena Konanova who is a partner at Selendy & Gay in New York but hold on a second. Hold on a fucking second let’s talk about the PSLF.

The PSLF was a law passed in 2007 aimed at helping people who go into careers of public service — teachers, nurses, police, public defenders and so on — overcome their debt burden. After ten years or roughly 120 payments in certain types of service jobs as defined by the government their loans are supposed to be forgiven.

This case against Navient by the way is separate and distinct from another one filed against the government in 2016 concerning the capricious redefinition of what public service jobs mean.

As part of their role in managing and collecting federal student loans on behalf of the government Navient is supposed to make borrowers aware of all the options available to them including if they qualify for PSLF. Since the program is administered by a different lender that would mean Navient loses the account and naturally they do not want to do this because their motivation is to suck as much money as possible from us.

“Tragically, it does not work that way in practice, in large part because the proper administration of the PSLF program depends on private, for-profit ‘servicing companies,’ with which the Department of Education has contracted to administer and manage federal student loan repayments,” according to the suit. “The PSLF program depends on the performance of these private servicing companies and their truthful communication with our nation’s most deserving borrowers when they are at their most vulnerable.”

In other words the massive company in question is being trusted to follow the law and do the right thing lol.

“Navient has not been living up to its obligation to help vulnerable borrowers get on the best possible repayment plan and qualify for PSLF,” the suit alleges. “Instead, Navient has harmed and continues to harm millions of hard-working public servants by routinely providing false information to these borrowers, preventing them from qualifying for the PSLF program.”

According to data from the Department of Education in 2018 almost 90% of borrowers who applied for the PSLF program since October 2017 were rejected. Only 206 had received loan forgiveness.

“This number is negligible compared to the estimated 32 million borrowers who were repaying loans that are potentially eligible for PSLF at the end of 2016, according to the Consumer Financial Protection Bureau,” the suit explains.

Why is that such a big problem? Mostly because student loan debt is ruining people’s lives and in particular people in low paying jobs that are vital to a healthy society like teachers.

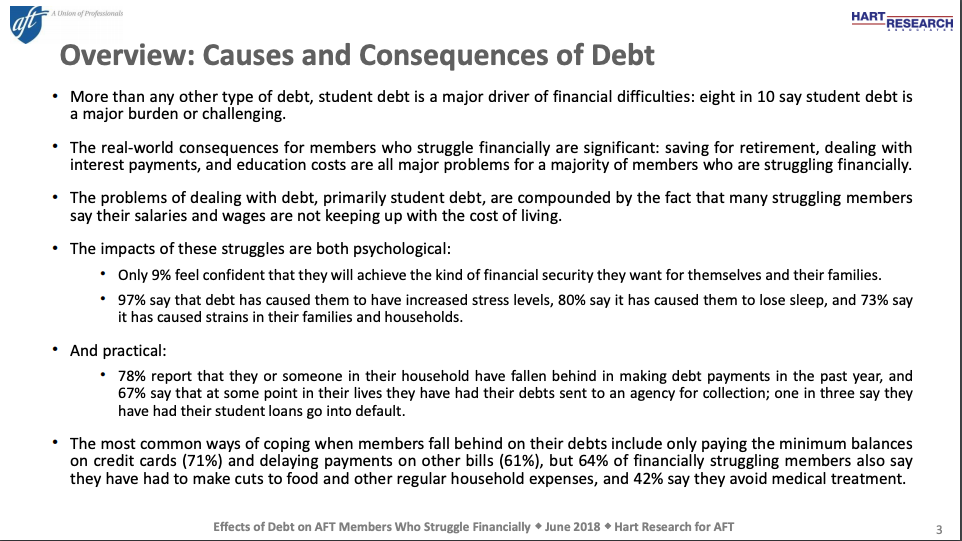

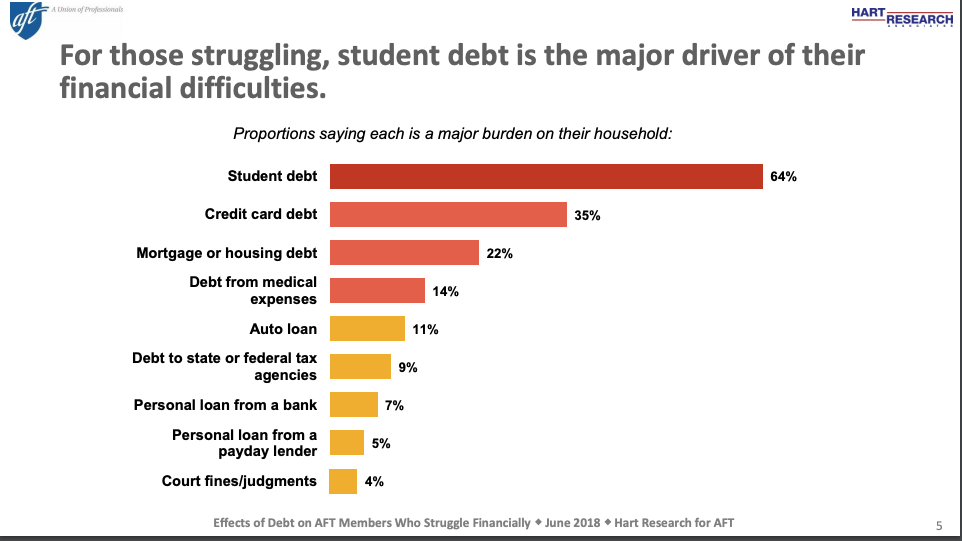

The American Federation of Teachers conducted a study recently in which 97% of responding members said student debt increased the stress in their lives and 80% said they had lost sleep over it. One third of them have their loans serviced by Navient. 80% said they were not confident they would ever reach the type of financial security they were hoping for.

“Navient has purposely and systematically trapped teachers, nurses and other public service workers under a mountain of student debt instead of providing them with accurate information about their loan options and the loan forgiveness programs they qualify for and deserve,” AFT President Randi Weingarten said in a statement. “No one goes into public service to strike it rich; they do it out of a deep commitment to students, patients and the public good. But we cannot attract the best and brightest to these careers if promises of debt relief are deliberately broken.”

“We’ve heard our members’ concerns and complaints about the ruinous effect of the debt on their lives, and we’ve taken on the student debt crisis as a union issue. It’s an epidemic, and people are suffering,” Weingarten said. “The stories from members haunt me: from new teachers who can’t stay in the profession because they’re defaulting on their loans, to experienced professionals who can’t retire because they can’t afford payments on their kids’ loans. This crisis affects us all.”

One such teacher is a woman named Kathryn Hyland who is the lead plaintiff.

Plaintiff Kathryn Hyland is a full-time public school literacy teacher and coach living in New York who took out a Federal Family Education Loan for both her undergraduate and graduate education. Ms. Hyland submitted her Employment Certification Forms to Navient in an attempt to apply for the PSLF program in January 2014. For three years, Navient informed Ms. Hyland that her employment was approved and she was “on track” for PSLF. Then, in December 2016, Navient informed Ms. Hyland for the first time that none of the loan payments she had made to that point qualified for PSLF because she had not consolidated her FFEL Loans into Direct Loans issued from the Federal Government. Ms. Hyland lost nearly three years of qualifying payments for PSLF. As a result, Ms. Hyland does not have money to purchase her own home, cannot afford after-school programs for her child, and must borrow money from family to send her daughter to preschool.

Pretty fucked up.

Ok this is all getting a little complicated so I called Lena Konanova one of the lawyers behind the suit to try to explain it better. Here’s that.

How would you summarize the class action suit you are bringing here?

We are holding a for-profit student loan servicer responsible for their misrepresentation and misconduct against public servants with respect to the bipartisan statutory Public Service Loan Forgiveness program.

Who is the PSLF supposed to be for? What types of jobs?

It’s for anyone who is in public service. The term isn’t defined by Congress, but it has been interpreted by the Department of Education to include anyone who either works in a 501c3 organization, or if not the organization devotes its resources to helping the public. So this include teachers, nurses, first responders, fire fighters and police officers, prosecutors, public defenders. Folks who have really devoted their lives to helping their communities.

In 2007 when this was passed it was a bipartisan effort and senators and congresspeople from across the aisle talked about the importance of incentivizing folks to go into these careers knowing that often they have to go to school to get the education and certifications necessary. But as I’m sure you know they don’t make as much money as they would in the private sector. Congress wanted to give them something to work towards. They said if you work in these careers giving your life to the communities and make payments for ten years the rest of your loans will be forgiven.

My wife is a teacher so I’m well aware of the struggles there. Are any of the stories from the people you are representing in particular beyond the pale?

I think all eleven of them are compelling. Our lead plaintiff Ms. Hyland has a particularly tragic story because she was so careful, so intentional in calling Navient and writing down what she was being told. Navient kept telling her she was approved and she was on the right track. It was only in December of 2016, after three years of these misrepresentation, that she was told by Navient that in fact she doesn’t qualify because she didn’t have the right loan program. She has two young kids at home, she devotes her working life to helping kids learn to read, and this is just a horrendous stress on her and her family that has left her and her young children really deprived of this statutory promise of forgiveness and with insufficient money to provide for basic school and nutritional needs. That’s just one example, but all eleven of our folks are in the same boat in that they reached out to Navient and were told lies by Navient. That’s really the focus of our lawsuit.

I do want to pause on this concept of are you in a qualifying loan or plan. These are complicated regulations that the DOE have set forth. Some folks have federal loans, or direct loans. Not everyone truly understand the difference between those loans. The government has said you need to have a direct loan to qualify for PSLF. And with the repayment plans as well the DOE has said you need to be in a qualifying plan, which means a standard plan or an income based plan. But if you are in an extended plan or a graduated repayment plan that doesn’t qualify.

It’s very confusing.

Most folks don’t have the foundational knowledge to know the difference between all those plans. Often they call in and say I want to qualify for PSLF, my payments are high at this point, could you help me switch into a more affordable payment plan? And it’s on the student loan servicer to walk them through that maze. The servicer, Navient in particular, have said we’re the experts, we’re there for you, call us with any questions. But Navient’s management has placed tremendous pressure on its call center employees to get off the phone as quickly as possible. They try to limit the call center conversations to seven minutes or less. So what happens is when folks call in the call center employees don’t go through sufficient detail to help them understand what kind of plan is qualifying. Instead they either shove them into forbearance, during which interest capitalizes, or say how about we put you on an extended plan where you have twenty five years to pay and your payments go down. But they misrepresent to them that that is not a qualifying plan for PSLF.

This is the jam that borrowers find themselves in. They are told to call Navient because Navient is the expert, and when they do they get wrong information and have their lives damaged.

The government seems to have made this all really complicated, but is Navient legally obligated to make this easier for their borrowers or are we supposed to be relying on their good will and ethical behavior?

They are legally obligated. They are the DOE’s agent. They are under contract with the DOE to fulfill this duty. The contract requires them to make such programs as PSLF and income based repayment programs available to borrowers. Their entire function is to give borrowers accurate information. It is an express legal obligation of theirs, and also an obligation imposed by state laws that we allege in our complaint are being violated by Navient. State laws mandate that companies don’t engage in fraud, don’t misrepresent facts to consumers. Navient is running afoul of those laws.

Is this a Trump administration thing or does it stretch back to Obama as well?

It’s been a problem for the entire duration of PSLF, twelve years so far. But there has been a real shift in this Trump administration where Betsy DeVos has come out and said she doesn’t think public service careers should be incentivized over other careers. In the Trump administration budget they proposed eliminating this loan forgiveness program altogether. So certainly this administration has tightened its grip on this program.

Why are so few people accepted into it and why do so few even apply? Do people just not know it’s an option?

Lots of folks don’t know it’s an option. Lots of others are victims of misrepresentation by servicers like this. We’ve had some folks that were told by Navient they don’t have PSLF, PSFL doesn’t exist. Some others like Ms. Hyland for example were told they are on track even though they don’t technically qualify. So when they apply they get dinged by the DOE who say no you don’t fit the criteria.

The other part of it is that you do need to have 120 payments, ten years of payments, so folks that started paying in 2007 when this first went into effect, those are the folks that could start applying in October of 2017. So as time goes by more folks are applying, but as you’ve seen, the slightest sliver are actually getting though. That is because many of them are victims of misrepresentation by their servicer, and others are being unfairly denied by the DOE. The DOE itself really is the principle here right? It’s their responsibility to oversee the servicers as well.

In March of this year there was a scathing report by the Inspector General at the DOE who really railed against the department and said they are failing at their job of overseeing servicers and monitoring their conduct. There’s enough blame to go around and unfortunately the folks that are being hurt are the public servants.

What is Navient’s deal? Is it just greed? Do they have any reasonable justification?

Number one, yes, the motivation is greed. They want to save money. They do that by keeping that call center conversations down to seven minutes or less. You can’t get anything done in that amount of time with finances. There’s also this component where if a borrower gets on track for PSLF, Navient loses that loan account, so it goes to a different servicer called FedLoan. So Navient is incentivized to not let that happen. At the end of the day it absolutely comes down to money for Navient.

Where is a trustworthy place someone can go? Who can they trust?

We’ve been working with the American Federation of Teachers, who have student debt clinics for example. They help people to figure out what kind of plan they are on, if it qualifies. They have a website as well where people can go see where there are clinics in their area and contact AFT. Lots of those emails come to us lawyers to see if they might qualify to be part of our class. If they are not we try to direct them to other available resources, other attorneys or non-profits that can try and help them.

The unfortunate reality is that this is really meant to be evaluated by peoples’ servicer since they have access to all their information. We’re trying to fix the system so the servicers properly work with them.